Page 68 - LIAM Annual Report 2020

P. 68

66 ANNUAL REPORT 2020

Life Insurance Business

This trend shows that during this unprecedented times, consumers are generally more mindful about their

spending and tailoring their purchases to smaller traditional policies (lower protection) due to the COVID-19

crisis which might have affected their financial situation.

In addition, during an economic slowdown, there is a tendency to shift from savings component type of plans

to basic plans with emphasis on protection.

Furthermore, activities of face-to-face life insurance selling were restricted during the pandemic. Investment-

linked insurance which is greatly affected, is an insurance plan which has more unique features and requires

face-to-face interaction by agents to explain these features and ascertain its suitability before an investment-

linked plan is recommended.

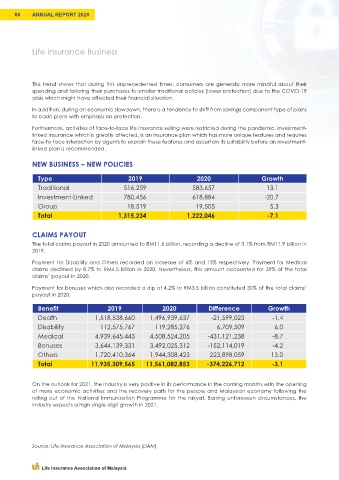

NEW BUSINESS – NEW POLICIES

Type 2019 2020 Growth

Traditional 516,259 583,657 13.1

Investment-Linked 780,456 618,884 -20.7

Group 18,519 19,505 5.3

Total 1,315,234 1,222,046 -7.1

CLAIMS PAYOUT

The total claims payout in 2020 amounted to RM11.6 billion, recording a decline of 3.1% from RM11.9 billion in

2019.

Payment for Disability and Others recorded an increase of 6% and 13% respectively. Payment for Medical

claims declined by 8.7% to RM4.5 billion in 2020. Nevertheless, this amount accounted for 39% of the total

claims’ payout in 2020.

Payment for bonuses which also recorded a dip of 4.2% to RM3.5 billion constituted 30% of the total claims’

payout in 2020.

Benefit 2019 2020 Difference Growth

Death 1,518,538,660 1,496,939,637 -21,599,023 -1.4

Disability 112,575,767 119,285,276 6,709,509 6.0

Medical 4,939,645,443 4,508,524,205 -431,121,238 -8.7

Bonuses 3,644,139,331 3,492,025,312 -152,114,019 -4.2

Others 1,720,410,364 1,944,308,423 223,898,059 13.0

Total 11,935,309,565 11,561,082,853 -374,226,712 -3.1

On the outlook for 2021, the industry is very positive in its performance in the coming months with the opening

of more economic activities and the recovery path for the people and Malaysian economy following the

rolling out of the National Immunization Programme for the rakyat. Barring unforeseen circumstances, the

industry expects a high single digit growth in 2021.

Source: Life Insurance Association of Malaysia (LIAM)

Life Insurance Association of Malaysia