Page 66 - LIAM Annual Report 2020

P. 66

64 ANNUAL REPORT 2020

PERFORMANCE OF THE LIFE INSURANCE INDUSTRY

Life Insurance Business

For the financial year ended 31 December 2020, the life insurance industry registered a moderate growth of

5.3% in total business in force from RM41.2 billion in 2019 to RM43.4 billion in 2020.

Despite the challenging business environment and the slowdown in the economy due to the COVID-19

pandemic, the life insurance industry achieved an encouraging growth in its Investment-Linked business,

recorded in force premiums growth of 9.8% from RM21.0 billion in 2019 to RM23.1 billion in 2020.

The total in force premiums for traditional policies grew by 1% to RM16.3 billion while Group insurance registered

a slight growth of 3.6% to RM3.5 billion.

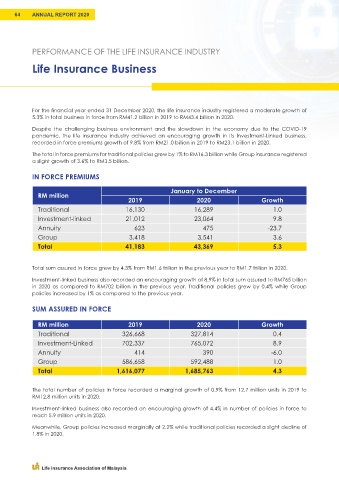

IN FORCE PREMIUMS

January to December

RM million

2019 2020 Growth

Traditional 16,130 16,289 1.0

Investment-linked 21,012 23,064 9.8

Annuity 623 475 -23.7

Group 3,418 3,541 3.6

Total 41,183 43,369 5.3

Total sum assured in force grew by 4.3% from RM1.6 trillion in the previous year to RM1.7 trillion in 2020.

Investment-linked business also recorded an encouraging growth of 8.9% in total sum assured to RM765 billion

in 2020 as compared to RM702 billion in the previous year. Traditional policies grew by 0.4% while Group

policies increased by 1% as compared to the previous year.

SUM ASSURED IN FORCE

RM million 2019 2020 Growth

Traditional 326,668 327,814 0.4

Investment-Linked 702,337 765,072 8.9

Annuity 414 390 -6.0

Group 586,658 592,488 1.0

Total 1,616,077 1,685,763 4.3

The total number of policies in force recorded a marginal growth of 0.9% from 12.7 million units in 2019 to

RM12.8 million units in 2020.

Investment-linked business also recorded an encouraging growth of 4.4% in number of policies in force to

reach 5.9 million units in 2020.

Meanwhile, Group policies increased marginally at 2.2% while traditional policies recorded a slight decline of

1.8% in 2020.

Life Insurance Association of Malaysia