Page 67 - LIAM Annual Report 2020

P. 67

ANNUAL REPORT 2020 65

Life Insurance Business

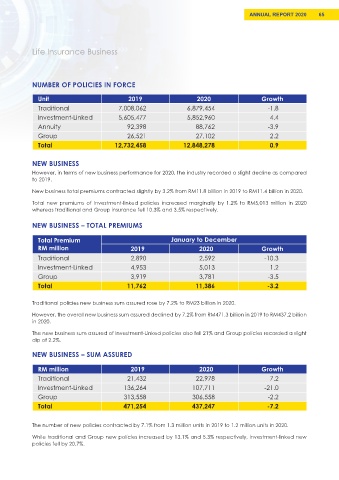

NUMBER OF POLICIES IN FORCE

Unit 2019 2020 Growth

Traditional 7,008,062 6,879,454 -1.8

Investment-Linked 5,605,477 5,852,960 4.4

Annuity 92,398 88,762 -3.9

Group 26,521 27,102 2.2

Total 12,732,458 12,848,278 0.9

NEW BUSINESS

However, in terms of new business performance for 2020, the industry recorded a slight decline as compared

to 2019.

New business total premiums contracted slightly by 3.2% from RM11.8 billion in 2019 to RM11.4 billion in 2020.

Total new premiums of Investment-linked policies increased marginally by 1.2% to RM5,013 million in 2020

whereas traditional and Group insurance fell 10.3% and 3.5% respectively.

NEW BUSINESS – TOTAL PREMIUMS

Total Premium January to December

RM million 2019 2020 Growth

Traditional 2,890 2,592 -10.3

Investment-Linked 4,953 5,013 1.2

Group 3,919 3,781 -3.5

Total 11,762 11,386 -3.2

Traditional policies new business sum assured rose by 7.2% to RM23 billion in 2020.

However, the overall new business sum assured declined by 7.2% from RM471.3 billion in 2019 to RM437.2 billion

in 2020.

The new business sum assured of Investment-Linked policies also fell 21% and Group policies recorded a slight

dip of 2.2%.

NEW BUSINESS – SUM ASSURED

RM million 2019 2020 Growth

Traditional 21,432 22,978 7.2

Investment-Linked 136,264 107,711 -21.0

Group 313,558 306,558 -2.2

Total 471,254 437,247 -7.2

The number of new policies contracted by 7.1% from 1.3 million units in 2019 to 1.2 million units in 2020.

While traditional and Group new policies increased by 13.1% and 5.3% respectively, investment-linked new

policies fell by 20.7%.